A full-page public interest advertisement in the leading national dailies of India on 22nd June 2021 presented the facts on Milk against the myths around Plant-based Dairy Alternatives. Issued by national dairy giant, Amul, the advertisement led to various discussions and debates on mass and social media. Irrespective of whether the views were pro- or anti- plant-based, the advertisement surely helped heighten the public awareness around this category of products in India.

For the uninitiated, milk substitutes from plant-based sources like soy, nuts and grains are favoured by consumers who are generally avoiding animal products, are fitness enthusiasts, seek novel products or are abstaining from dairy due to various health condition, like allergies or lactose intolerance.

It is widely reported from various studies that about 60-65% of Indians are lactose intolerant without realizing it; and plant-based milks are free from lactose. This was one of the main premises that helped companies promote the merits of plant-based milk all around the world. Although some dairy milk manufacturers have introduced lactose-free variants of dairy milk, plant-based options are deemed more popular in this regard. Also, the calorie value of a typical unsweetened plant-based milk is about 30-50% lower than that of a standard toned milk. In addition, the former has a lower fat content, and is free from cholesterol. However, plant-based milks are no match to cow’s milk when it comes to protein, calcium, potassium and other minerals. To address this gap, plant-based milk products are fortified with essential and desirable nutrients. As for sustainability, all plant-based milk alternatives are estimated to be nearly 70% efficient as dairy milk on emissions, land use, and water usage aspects.

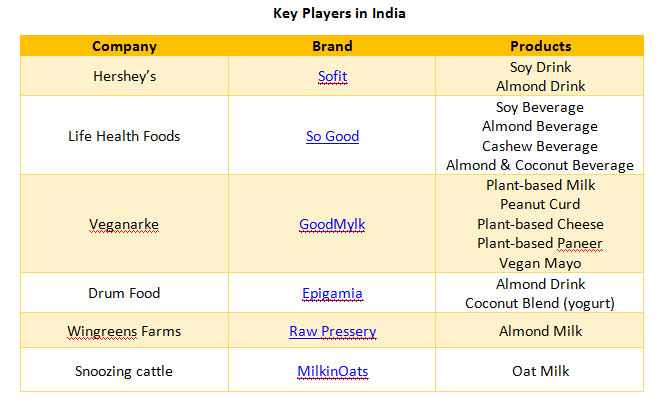

Valued between USD 15-18 billion in 2021, plant-based milk alternatives is one of the largest categories within the plant-based foods market globally. Asia Pacific accounts for nearly 50% of this market. Soy, Almond, and Oats-based are the leading variants, with a growing interest seen in rice, legumes and nuts-based milks – pea, coconut, cashew, for instance. The market is projected to grow at about 8-10% Y-o-Y through 2026, driven by evolving plant-based food trends. Some of the notable players in the world market today are Danone (Silk, Alpro), Blue Diamond, Oatly, SunOpta, and Sanitarium Healthfood Company (So Good).

Despite all the buzz around it, plant-based dairy alternatives is small in India, estimated at around INR 200-250 Crores (USD 30 million approx.). While this may seem paltry when compared to the INR 11 lakhs crore (USD 150 billion) dairy market, the category has gained massive interest among new age consumers, thanks to endorsements by celebrity influencers adopting a vegan lifestyle and wide media coverage across platforms. Although it is too early to assess, industry sources suggest a projected growth rate of nearly 20% for the category in India.

Health and wellbeing, sustainability and lactose intolerance are found to be the key purchase drivers for plant-based dairy alternatives in India, as per GFI India’s 2020 report – Insights on the Plant-based Milk Category in India.

With consumers becoming increasingly aware about the category, competition from peers and traditional dairy intensifying, and product claims becoming more tall and nuanced, it is important for any incumbent or new entrant to factor in the below aspects during product development and innovation:

- Taste and Health Parity with Dairy Milk: Taste and health benefits are observed to be two key purchase determinants for plant-based milk alternatives. Addressing the market gaps on these fronts presents an innovator with an opportunity to differentiate his/her creation in the market place. For instance, even the most passionate consumers of plant-based milk rate dairy milk to be tastier. Although there has been efforts to remove or mask any off-taste (nutty, beany, etc.) derived from the source ingredient, there is still a long way to go for most products available in the market today. Similarly, cow’s milk is still considered more wholesome naturally as compared to plant-based milk options. The product formulation for the latter has to ensure that it provides the target consumers with all nutritive benefits that they seek from the product.

- Affordability: While the retail price for cow’s milk typically fall between INR 45 and 75 per litre, prices for milk alternatives vary from INR 140 for soy-based, to INR 250-400 per litre for cashew, almond and oats-based options. While this is justified by the novelty factor associated with plant-based milks today, it could be a barrier when the market is poised for a wider adoption in near future. Alternate options in ingredients, formulation, technology, or even supply chain could be considered to ensure that the products become more affordable to the regular consumers as awareness and intent to purchase grows.

- Versatility: Share of Indian consumers who drink milk directly or with breakfast cereals is miniscule as compared to the western countries. In a typical Indian household, largest share of milk is consumed in the form of tea/coffee. Part of it is used to prepare curd, and the rest is used in various dishes or beverages, albeit occasionally. Hence, for a milk alternative to be seen as a true substitute to cow’s milk, it is only natural to expect that it matches the latter in popular applications. Most plant-based milk alternatives available today doesn’t perform well enough in applications like tea, coffee or desserts owing to the taste and/or composition. This may be considered to be a sizeable gap in the industry today which, once addressed, could help in massive adoption of the category into Indian households.

- Variety: Indian dairy basket is diverse with derivatives like paneer, curd, ghee, butter, yogurt, ice creams, and cheese, all for which are large segments by themselves; add to this the endless range of milk-based desserts and beverages prepared at homes, sweet shops and food outlets. An entrepreneur has a sea of opportunities available to explore with options in plant-based alternatives. While some brands are indeed experimenting with products like cheese and yogurts, a sizeable market is still available for these and other ready-to-use dairy derivatives or even ready mixes, like a vegan kulfi mix or vegan gulab jamun, for enthusiasts to try at home. Experimenting with new ingredients, like pea, rice or different nuts, or creating new formulations with dairy alternatives that are popular today, could be pursued to open up new avenues in the space.

Considering all the above factors, plant-based milk alternatives remain relevant as a dietary choice. However, given our strong association with traditional dairy as a part of our cuisines and culture, it is highly unlikely that it gets entirely replaced at any point in near future. Rather, the current market dynamics and consumer preferences indicate a potential for both categories to co-exist and grow in their own rights. This outlook is already evident in the number of brands, both national and multinational, industry leaders and start-ups, looking to enter into this lucrative space of plant-based dairy alternatives.

Plant-based dairy alternatives as a category has managed to carve a niche for itself, and is only bound to grow with improved consumer awareness and smart product development and positioning. It is highly likely that these products find space in retail shelves alongside the traditional dairy and both categories continue to meet the needs and requirements of the respective consumer cohorts over the coming months and years. The key to success, nevertheless, remains on identifying the right target audience, their needs and preferences, smart product formulation, and positioning it to ensure that it delivers the optimum value for money.

Symega Food Ingredients (www.symega.com) is engaged in developing, manufacturing, and marketing sensory solutions for food, beverage, and allied industries. As one of the most innovative plant-based companies, Symega is at the forefront of plant-based food development. At Symega Protein Innovation Centre (SPIC) in Kochi, Kerala, our food technologists and sensory experts collaborate with our customers to develop plant-based food – milk, meat, cheese, egg and their derivatives – that meet the market trends and evolving consumer expectations. Plant-based dairy portfolio from Symega includes rice, oats and almond based milk, butter, cheese, yogurt, and a range of vegan premixes for desserts like gulab jamun, kulfi, ice creams, and more. SPIC is currently open to business visitors to co-develop and explore endless opportunities in the space of plant-based foods. To know more connect with us at marketing@symega.com.

Authors:

Rethesh Kumar : Business Head, Specialty Foods

Krishnadas G : Marketing Manager

References:

- Insights on plant-based milk category in India (2020), Report by GFI India & Ipsos.

- GFI State of the Industry Report 2020 – Plant-based Meat, Dairy and Eggs

- sciencefocus.com (Sustainability: dairy milk vs milk alternatives)

Originally published in Food Marketing & Technology Magazine and archived here.